The American Housing Crisis

The American dream of homeownership has become increasingly elusive. Over the pandemic, a significant share of affordable homes disappeared, leading the supply to hit its lowest level on record in 2023. Soaring home prices and high interest rates have priced many buyers out of the market. In 2023 alone, the number of affordable homes shrank by almost 41%, equal to over 243,000 properties.

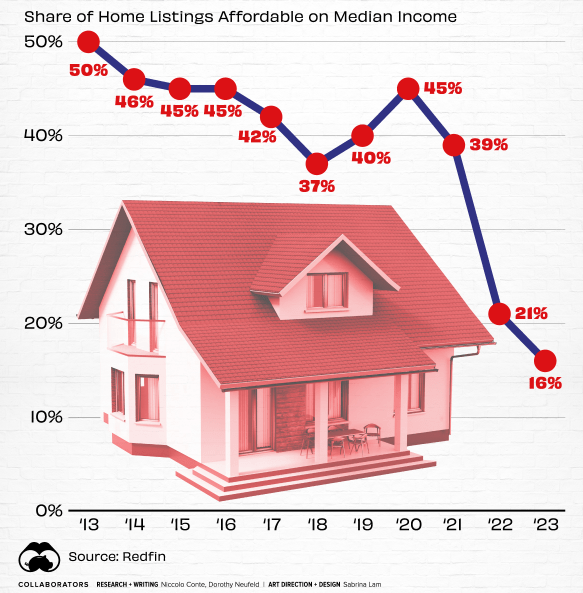

In 2023, only 16% of homes were affordable in America, falling from 21% in the year before. An affordable listing was defined as one with a monthly mortgage payment no more than 30% of the median monthly income of that county.

Here is the share of affordable listings in the 97 biggest U.S. metropolitan areas by population over the years:

| Year | Share of Affordable Home Listings | U.S. Median Sale Price on New Home | Average 30-Year Fixed Mortgage Rate |

| 2023 | 16% | $427,400 | 6.81% |

| 2022 | 21% | $457,800 | 5.34% |

| 2021 | 39% | $397,100 | 2.96% |

| 2020 | 45% | $336,000 | 3.10% |

| 2019 | 40% | $321,500 | 3.94% |

| 2018 | 37% | $326,400 | 4.54% |

| 2017 | 42% | $323,100 | 3.99% |

| 2016 | 45% | $307,800 | 3.65% |

| 2015 | 45% | $294,200 | 3.85% |

| 2014 | 46% | $288,500 | 4.17% |

| 2013 | 50% | $268,900 | 3.98% |

As the table shows, housing affordability has grown increasingly out of reach as mortgage rates have more than doubled in just two years. While affordable homes made up 39% of the market in 2021, the share dropped precipitously as interest rates climbed higher. In 2023, the average annual 30-year fixed mortgage rates reached 6.81%—hitting its highest level in 20 years.

The Canadian Housing Affordability Crisis

The situation is not much different in Canada. Young Canadians, even those with good salaries, are finding it increasingly difficult to own a home. According to a report by Statistics Canada, affordability issues are casting a shadow over the economic futures of young Canadians¹.

Young Canadian households (where the primary earner is under 35 years old) were the only cohort to see their mortgage burden decrease year-over-year in the third quarter of 2023. This could be because young Canadians are paying their mortgage debt down faster, forgoing buying a home at all, or downgrading to more affordable accommodations.

However, the agency noted that younger households are starting to turn away from the housing market. Renters, many of whom are younger, face rising costs, keeping homeownership out of reach¹. Renters were flagged as being more likely to face financial difficulties compared with homeowners.

Looking Ahead

The good news is that new-home construction is forecast to increase in 2024, with single-family housing starts projected to grow 4.7%. While new home sales have historically comprised 10-12% of the single-family home market, they have recently surged to 30% due to the collapsing supply of existing homes. But even as new supply enters the market, it will likely take a number of years for housing affordability to return to historical levels.

In fact, JP Morgan suggests that it could take two years if mortgage rates drop by 1 percentage point, assuming that home prices remained at all-time highs and wages continued rising at their current pace.

The housing affordability crisis is a complex issue that affects both the U.S. and Canada. It’s clear that solutions will require concerted efforts from all stakeholders, including governments, lenders, and home builders. As we look to the future, it’s crucial to keep the dream of homeownership alive for the next generation.

Sources:

(1) Affordability issues are ‘casting a shadow’ over young Canadians …. https://globalnews.ca/news/10386858/affordability-issues-casting-a-shadow-over-young-canadians-economic-futures/.

(2) Housing Affordability Hits Home: A closer look at Canadian families …. https://abacusdata.ca/housing-affordability-hits-home/.

(3) Why housing affordability is hurting – Unlocking the Door to Homeownership. https://affordability.ca/information/what-affects-housing-affordability/.

(4) A tale of two renters: Housing affordability among recent and existing …. https://www12.statcan.gc.ca/census-recensement/2021/as-sa/98-200-X/2021016/98-200-X2021016-eng.cfm.